The Uranium spot price according to UXC.com is currently near 70 dollars per pound as of January 12, 2011. I check the price occasionally and have been thinking about this sector for quite some time now. I believe the uranium spot prices are updated every Monday but then released in delayed fashion by Tuesday or Wednesday of every week. Then on month end there is the net change per month also published.

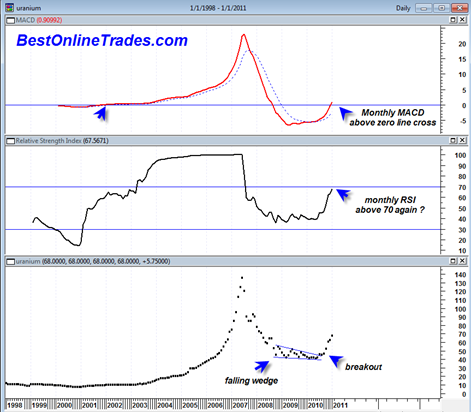

I have written about the uranium price before and what surprised me the most about this commodity is its ability to trend persistently higher in almost vertical fashion. I have plotted the month end uranium prices in my charting program and between the period 2003 to 2007 the relative strength index of the uranium price trended above the 70 percentile line and then hit a maximum level of 99.97 based on monthly uranium prices.

If you have been reading my postings here occasionally or regularly at BestOnlineTrades.com then you will know that I like to keep an eye on the Relative Strength Indicator as a measure not only of overbought levels of any stock or index, but also as an indication of when a stock or index enters the ‘power zone’. The power zone is the level above 70 and generally speaking one tends to see persistent trend strength above this range.

The chart of the monthly uranium spot price above shows the current trading dynamic. Note the quite large falling wedge that was building between 2009 and 2010.

Now the price of uranium has broken out of this falling wedge and appears to be in a new uptrend. Given the nature of the euphoric price peak near 140 that occurred in 2007 I am tending to think that the uranium price in the year(s) ahead will at the very least test this old high.

In elliottwave terms I believe the current leg up would be primary wave 3 up which tends to be the strongest and longest wave.

If we compare the uranium spot price structure above to the gold price it seems as though uranium represents a much better risk reward in that we seem to be in a much earlier phase of the current run up. The gold price and the gold mining stocks have travelled so far and so long that the uranium miners and the uranium price seem to pale in comparison. And in terms of supply demand, the uranium sector does appear to be a niche energy sector play with only a small handful of uranium mining stocks to choose from whereas in the gold sector we already see that there are more than a few hundred gold mining stocks to choose from.

The uranium mining stocks such as URRE, URA,URZ,DNN,CCJ also seem like they are in only round 3 of a 10 inning ball game to the upside. I am basing this judgement on the longer term chart structures of the uranium mining stocks, the long 2 to 3 year bases, and the enormous breakout volume out of these bases within the last 6 months.

So I think it could be prudent to embark on a uranium mining stock accumulation stance for the next year or two as we see the uranium spot price start to ascend higher.

The uranium mining stocks have moved very fast during the last 6 months. They may be due for a major correction the next month or two, but I am looking to accumulate them on some meaningful correction during the next couple of months.

Of course it is unknown whether or not the uranium price will be able to launch a repeat persistent performance as it did into 2007. Past performance is no guarantee of future results as they say.

But whether the uranium price travels up in a straight line or more of zig zag pattern seems to be besides the point. The long term monthly chart above shows that longer term momentum is clearly indicating higher prices. Uranium prices can stall out but they are likely to maintain forward momentum based on my read of the above chart.

The uranium mining stock URRE looks especially attractive near the 2.0 range. These stocks have a record of being extremely volatile so URRE could still be in a very solid uptrend even on a pullback to 2.0 range.

I definitely think one has to view the uranium mining stocks and the uranium price as a longer term chart and sector play. The sector seems to offer upside that is still in the early phases whereas almost everything else has been shooting to the moon for almost 2 years now.