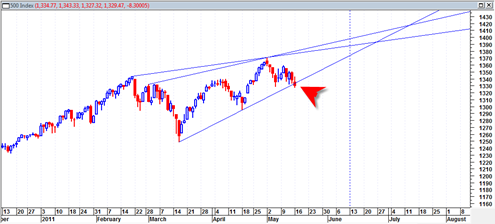

Today was another minor downside follow through day. Not exactly the type of action I was looking for in terms of bearish confirmation. Still, we did slightly pierce the up trend line since mid March 2011 and today is after all a slow trading Monday.

So we will have to see if the market can build some more downside momentum the rest of this week. Monday’s are typically slow especially in the summer months.

The daily candlestick today was sort of resembling an an inverse hammer which could lead to an upside bounce tomorrow, but I prefer to keep with the original theory that we are slowly building some steam for a further downside type move. The summation index is starting to roll over and seems to be confirming more downside into end of this week.

Technically the sp500 is still holding onto the support area at 1330, so we really need to start seeing some break down this week to get the ball rolling below support. If not, then this could be a situation of the market holding trendline support. Tomorrow is probably a key day.

My theory is that Russell 2000 and QQQ will lead SP500 down. The broader market is not healthy when Russell and QQQ have totally and completely broken the trendlines.

I look for SPY to follow the other two indecis (down) not the other way around.

Market is weak.

Tomorrow may see a bounce. Turnaround Tuesday and a full moon. But my technicals are on a higher Dollar and VIX while the equities and silver will see more down side

As long as Russell 2000 is acting badly, I am not bullish on this market. The risk is leaving the market, and going to utilities, and other defensive stocks. Typically, such stocks over-perform in the tired stages of the bull market.

I am shorting “risk” until further notice.

VIX and higher dollar are good bets.

The Wilshire 5000 is typical of this market. It is resting on its 50 day moving average. So is the $SPX. At this point it seems to be more probable that the market will now move agaub to the up side rather than break through to the down side.

QE2 is not over. If we were closer to mid June, I might have a different opinion. But with that force still active on the up side and the movement so far being well within an upside trending market, the better play is still up.