The sp500 and the SPY ETF have really been struggling to gain positive ground that would help bolster the case of a renewed short term uptrend.

Basically the SPY has been doing almost nothing as of the recent several trading days. The large reversal hammer that was created 2 days ago so far has not resulted in a fast renewed uptrend which is a bearish sign.

Certainly there are still a good handful of stocks that are behaving well and breaking out… but it seems as though we are in a very mixed market where half look good and the other half look bad and this is showing up in the indices as a slow and sloppy tape action.

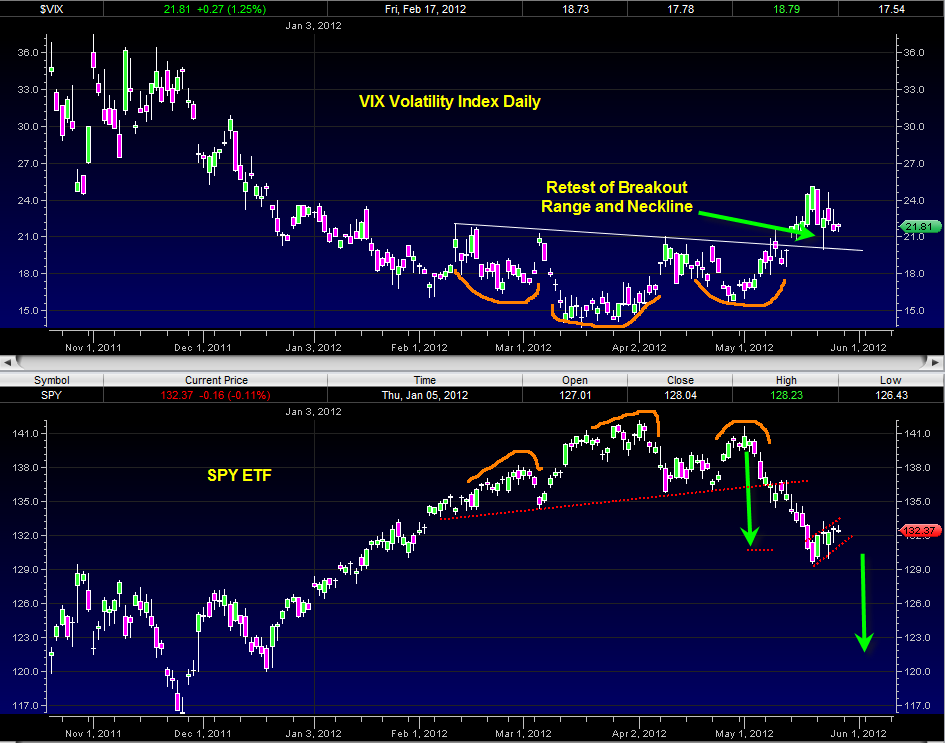

The side by side chart comparison of the SPY versus the VIX (volatility index) speaks quite loudly at this juncture.

Perhaps at this point in time it is best to ignore the little ripples of the market and just focus on this side by side comparison which suggests we have more down to go out of the bearish rising flag pattern and that VIX eventually wants to resume upward again.