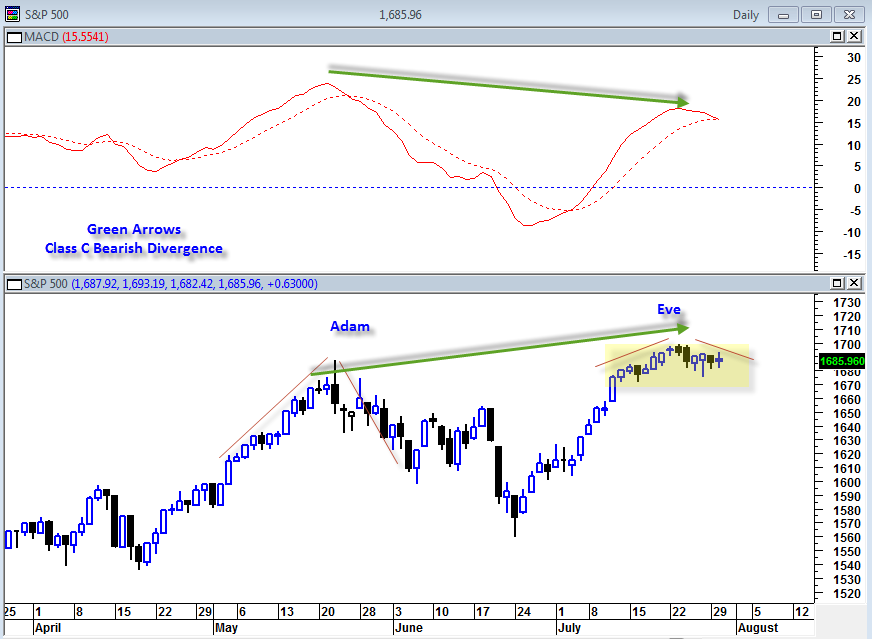

There are a couple possible warnings flags of potential bearishness in the sp500 daily chart as of this writing. I am seeing a class C bearish divergence between MACD and price in the daily sp500 price chart. The class C bearish divergence is labeled class C from Alexander Elder’s book Trading for a Living where he defines three types of bearish technical divergences, Class A B and C. Class C bearish divergences are supposed to be the ones offering the most bearish potential.

In addition to the class C bearish divergence we have what looks like an Adam and Eve topping pattern where we see this secondary price consolidation as being rectangular and sideways in formation which contrasts against the previous spike or ‘V’ type peak of the time period May 21, 2013.

The above two possible bearish criteria are given a little more emphasis given that we are trading in a bearish potential zone seasonally (August to October).

There is also an important cycle date according to Marty Armstrong that will arrive next week on August 7th, 2013. This cycle date could either be a low or a high, or it may not work at all. Still, it is worth paying attention to and observing how the market technicals are behaving near this date.

Today is a FED decision day and so could serve as a pivotal turn point day for the markets, or it could already be baked in as they say.

The bullish interpretation of the above chart is that the market has held its ground quite well in sideways rectangular fashion and could serve as a spring board for a northward breakout with today as the catalyst. That is simply another possibility but would then open the door to August 7th of next week being some type of turning point.

We will just have to wait and see what if any type of reaction the markets deliver today. The bias is still clearly very strongly up and of a buy the dips mentality. So it would take a serious effort to try to stop that positive trend. Whether today is the day for that remains to be seen…