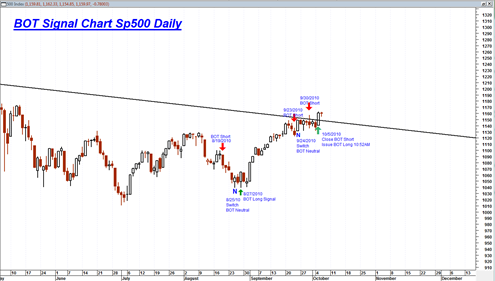

The sp500 today broke out north from the tightly compressed downward sloping trading channel we have been working through the past several weeks. The market appears to want to move higher again to a new 52 week high eventually.

At this point this is a clear long signal again, but I am holding off switching to BOT long signal and instead take a wait and see attitude on whether the market can make a new 52 week high. We are only about 8 days away from the June 13, 2011 cycle turning point of Marty Armstrong and I would rather wait and see if any type of turn occurs on or near this date. This is partly why I am just switching to neutral for now.

You know the old saying ‘a wolf in sheep’s clothing’. Well in this case the wolf is the long side and the sheep’s clothing is the neutral side. Basically I believe the long signal is correct going forward again, but I would rather bide my time and stay with neutral until I see true northward confirmation.

Put simply, I want to see full sp500 price bars above 1370 before switching back to long signal. That should be more than enough time to see what, if any, effect the 8.6 year cycle point has on the market.