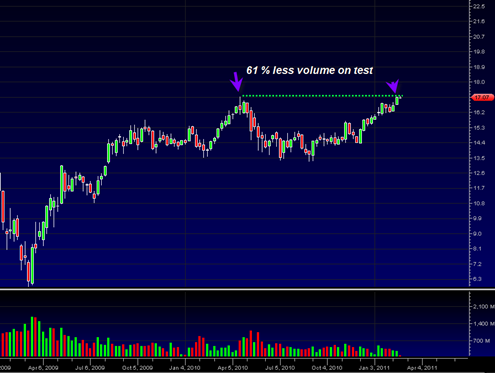

Today the SPY ETF Bottomed with a bullish spring formation in relation to the 3/16/2011 price swing low. It was a bullish spring and rejection of that 3/16 low and volume shrunk by about 21%.

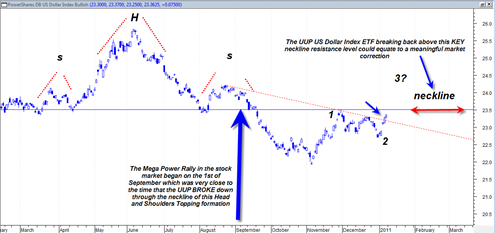

So it is clear to me that we have bottomed in the short term and are now set to work higher in some type of counter trend rally higher. This may end up being a low volume rally higher relative to the recent heavy volume decline and would set up a possible ideal re shorting opportunity in mid to late August 2011.

It is quite clear to me that the next big decisive move in the market will occur in the late August to early September 2011 time frame.

Counter trend rallies can sometimes extend a lot higher than at first thought. I am thinking the SPY could get to the 130 to 131 range with an outside possibility of 132.5 as the most optimistic scenario. The weakest bounce scenario would be about 128.5.