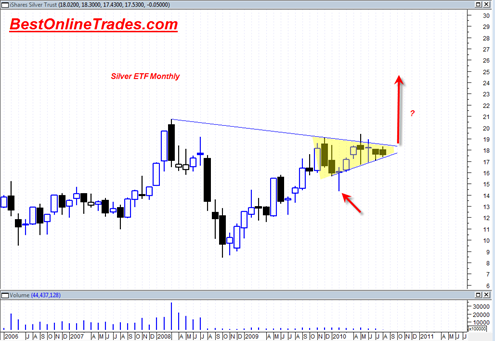

The relative strength of silver futures relative to gold is quite amazing to watch in recent months. The current tape action of silver futures and the silver ETF is almost better than textbook type price action. Up days are much more frequent than down days, and when an occasional down day does occur it is often in the form of a constructive candlestick formation. The up day price bars how a persistent replenishing demand for silver and show that strong hands are in control.

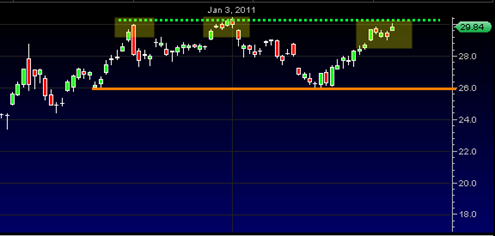

From March 7 to March 15, 2011, silver futures took a bit of a hit which was in tandem with the sp500 ‘Japan earthquake’ correction. But now during the recent 3 trading days we see that silver futures have bounced right back up to near the 52 week high range almost instantly like a powerful spring. Silver has basically said if it had a voice, “I don’t feel like correcting now and will strongly reject the 33.5 range and try the other side”. The other side in this case is 36.50.

Both Silver and Gold have been great early indicators or sensitivity indicators to look towards when trying to gauge the potential for how serious a broad market correction will be. If you see gold and silver very reluctant to give back ground during an sp500 correction, then it could imply the stock market correction will be limited. This appears to be the case right now.

It looks like the other side is going to be busted in short order to the upside which could even further accelerate a parabolic move for silver towards the 45 to 50 range. This could be a very fast move if silver is able to successfully break above 36 with conviction. If we look at the move that started in late January 2011 and then measure up to the recent minor correction, it could imply that the recent correction is serving as a pausing point and half way move point for a follow on move of about 9 dollars which would target the 45 range as a target. If correct, then this 45 range target could come quite quickly. As I alluded to several times before, the metals are moving into parabolic mode which means faster moves with possible multiple unfilled continuation gaps to the upside.