The GLD was down slightly today but the volume was the lowest volume we have seen on the GLD since Christmas 2008. The volume today was 3.97 million shares. For the GLD this is the equivalent of holiday trading volume.

This is significant to me for a couple of reasons.

One of them is that it confirms the fact that we are right inside the apex of this large symmetrical triangle on the GLD since February 20th, 2009. Volume declines into the formation of a symmetrical triangle is expected. During the entire formation of the triangle, the bulls try to rally price higher and then the bears slam price lower in successive steps each slightly higher and then lower as the pattern progresses. It is a frustrating pattern because it seems that no significant progress is being made either up or down.

But progress is being made in the sense that significant cause building (energy) has occurred which will eventually see a resolution. My bias has been for an upward resolution out of this pattern.

The low volume on the GLD today also says to me that we are getting pretty close to the end of this pattern. I interpret it (since I have a bullish bias) as a signal that most of the last remaining sellers are done.

The US Dollar rally so far has simply not materialized. On the contrary the price action is looking really weak lately to me.

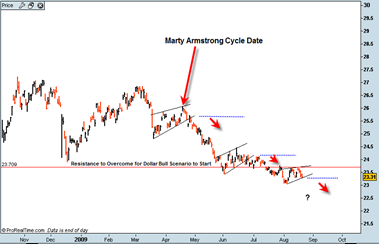

The UUP ETF chart (US Dollar ETF) so far at least paints a picture of a clear downtrend and rising wedges that continue to be broken on the downside in continuation action. The Marty Armstrong Cycle Date of April 21st 2009 nailed an important turning point in the Dollar precisely as shown in the chart. Since it hit that cycle date the technical action has been nothing but downside.

Will that downside continue?

It will if the Dollar is not able to break above that red resistance line. It needs to do that as a first sign to me that a more significant counter trend bounce is about to start. But so far it cannot get the job done.

I still consider the next two weeks of market action in both the US Dollar and the Gold Price to be possibly very pivotal action. A decision has to be made at some point and I am thinking that the decision will be made in the next 2 to 3 weeks.

If the gold price breaks upward, then it should lead to a fairly persistent price advance that lasts between 6 to 9 months, maybe even a full year.

The GLD is deceptively quiet in terms of both price and volume today! It is Christmas in August 2009… and volatility has come to a near stand still.

Lets see if all that changes in the next 3 weeks…