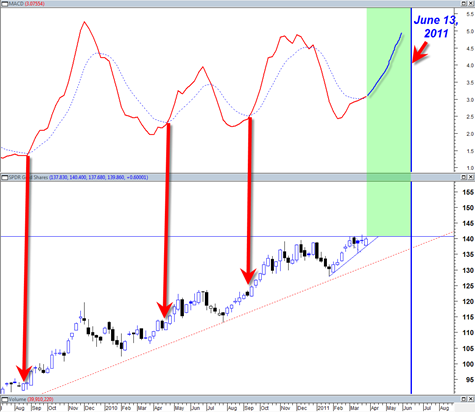

The gold price managed to pull a rabbit out of the hat today and blast higher, which structured the weekly MACD into bullish crossover mode. As of yesterday there was a risk that the GLD ETF would not be able to achieve a bullish weekly crossover and that instead we would see a ‘bear kiss’ of the weekly trend which would have put the gold price at risk of a possible break down.

Instead this ‘miracle worker’ of a commodity busted higher today and now situates the gold price in a stance for a new life time high type breakout which could be quite dramatic. I should say though that every time I have expected or anticipated the gold price to somehow shoot up 100 dollars in a day, it has ALWAYS disappointed me and instead trickled up like molasses keeping under the radar of almost every market watcher.

The weekly chart of the GLD is indicating that the breakout should occur during the next two weeks assuming upward momentum holds on the current up trend line.

The gold price breaking out north would seem to also support a further upside move in the silver price, perhaps into the 50 to 55 range.

What is odd is that the current seasonal time frame of April and May is maybe the worst seasonal time frame for strong gold prices, so it will be interesting to see if gold can evade the weak seasonals and breakout higher strongly.

Personally I think the gold price will break out and trend higher for the next 1 to 3 months.

The weak US Dollar Index seems to be helping this trend along quite well. The US Dollar Index is in a clear monthly bear trend after having broke down through a 5 year triangle consolidation pattern.