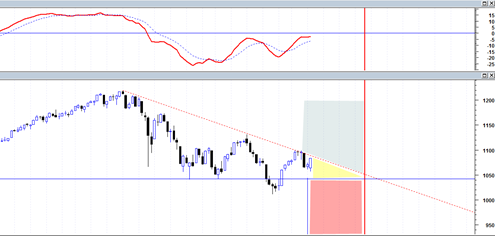

The market action today was not the stuff of bear market action. It was a massive bullish engulfing of a previous day indecision doji. The daily MACD histogram sell signal which I mentioned yesterday would likely be confirmed today was not confirmed today. In addition the WEEKLY macd histogram at least as of the second day of this week is confirming a weekly bullish buy signal.

This would be a big problem for the bear case and if we finish the next three days of this week at the same level we did today or higher, then the bulls are going to win this one. If they do win it then they will likely bust the descending triangle I talked about yesterday to the upside which could lead to a very large move topside.

If that happens then I have to resort once again to my hyper bullish mid 1970 scenario (related bullish 1970s scenario) which is based on the premise that the market is showing tremendous internal strength because it has so far only done a 38% retracement from the March 2009 lows.

I can understand why the bears would be extremely frustrated at this point. The bearish topline news from IBM and GS and a few other stocks yesterday seemed like it was the final nail in the coffin to slam this market down big time.

Instead today we did a big bullish engulfing. Also the NYSE Summation index busted above the zero line which is a bullish sign.

The daily MACD was ‘supposed to’ turn down after bumping its head right under the zero line for the second time. Instead it is now evading a bearish cross and it may actually turn up above the zero line which would be very bullish.

We may be only 3 days away from a final verdict on this market as far as super bear or super bull scenario.

If the market busts higher above the red dotted downtrendline during the next three days then the bulls may be running the show for quite a long while and the bears may have to admit defeat.

That is my take right now based on the price patterns and indicators.

The bears really need some hard down the rest of this week to tip the scale in the other direction and tip the indicators in the other direction as well. If they cannot get the job done the rest of this week then it is going to continue to curl up the indicators into strong bullish territory and evade all the potential bearish signals.

I think it is prudent to keep the mid 1970’s bullish scenario in your back pocket at this point. While it may seem impossible for stock prices to head higher given all the bad economic news we have to respect what price tells us.

Another discouraging day for bears. Very discouraging. I recall that a TA commentator on Kitco site posited that the longer a trend stays within a wedge formation, the eventual move outside the formation is less intense. If true, that commentary is counter-intuitive, and would frustrate both bulls and bears.

With Bernanke giving testimony before the Senate tomorrow, it is difficult to fathom how he could be too ebullient, but on other hand he would not want to scare the market.

Today was discouraging day without a doubt.

I am still waiting for a big up open, that would take us above the down trendline, weak short will close in 1st half of the day and then selloff into the close to take us back under the line. 1970 scenario is baloney – the market will just frustrate the heck out of shorts and then rip down.

Three wave pattern emerging. if Helicopter Ben talks big then S&P may break 1102 on target to reach 1146.7

If Ben says nothing we go below 1180 on S&P.

Yes Geoff it sure is whipsaw city lately in the market.

Arsen, yes indeed I think the word frustrating describes the market very good right about now.

I see that pattern also shrihas, but with today’s failure again maybe resistance succeeds for good this time.