Today is another interesting day on Wall Street. The Arms index hit a high today of close to 3.65 and tells me that today’s decline is most probably a one day oversold type event. The market was very clearly in heavily overbought territory and very overdue for some type of pullback. And so when any market gets in such a severe overbought level the smallest piece of news can be enough to get a big correction going.

How we close today will still be important as a setup going into next week. If we close near the lows today then it could be a sign that next week will see some downside follow through. On the other hand a decent end of day rally today may set the stage for a bounce next week to work off this oversold situation right now.

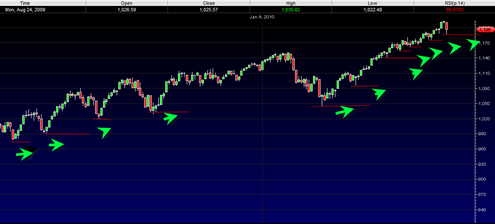

It is possible that this is a more significant top, but we will probably need another attempt at the highs for better confirmation. So far the SP500 is still trading in a higher highs and higher lows type situation and until that changes I give the benefit of the doubt to the bulls.

The higher highs and higher lows tape behavior has been symptomatic for a long time and while it can change at any time, we must assume that this trend will remain in place,… until it doesn’t.

Goldman Sachs earnings are coming out I believe on Tuesday and will probably get investors buying that stock again and coming back to their senses.

Generally speaking market tops are not made in spike fashion in just one or two days. It is more of a process and a tiring battle.

But market bottoms can and do occur in just a single day. Take for example the March 6, 2009 low. That was one of the most important lows of this decade probably and it occurred on a SINGLE DAY!