If you have been reading posts here at BestOnlineTrades then you probably already know that I am ‘looking for’ a price movement that has less resistance on the downside rather than upside (note: I am purposely trying to avoid using the terms ‘bearish’ or ‘bullish’ because of the inherent emotional bias it can build in any trading plan. I picked up this tip from the book ‘Trade like Jesse Livermore’).

Today’s action in the sp500 and the other major indices was impressive in terms of points, but not impressive in terms of volume. If the sp500 closes above 1209 tomorrow or in any of the upcoming days of this week, then it could be that my analysis is completely wrong, and opens the door to at least the possibility of new all time highs.

I very much doubt the scenario of new all time highs however and continue to be confident in more downside price resolution in the days ahead.

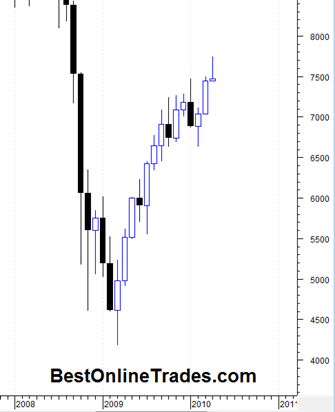

The monthly New York Composite Index candlestick chart is showing that the month of April has shown pretty close to being a gravestone doji or a reversal hammer. The significance is magnified in the sense that this is a monthly candlestick and not a daily or weekly candlestick.

It is also significant that this reversal candlestick is forming on the NYSE because the NYSE composite index is one of the most broadly diversified indices.

It suggests that the month of May will result in downward price resolution.

Today we had the opening price action of the month of May and the NYSE composite index closed at 7543. It is usually expected on the first trading day of the next month for price to move into the previous candlesticks range. So I suspect that today’s low volume up move was simply just that. A little ‘teasing’ into the April gravestone doji candlestick only to result in downside price resolution later this week.

Volatility is definitely on the rise and you can see the market forces becoming somewhat more unstable and fighting for a clear direction. This is the exact opposite of what was the case for the trading action since the February 2010 lows.

May 2010 should be a very interesting and highly volatile month!

Still long the TZA Direxion Daily Small Cp Bear 3X Shares going into the month of May.