This last week of upside trading was a total blow out to the upside. It was almost as if ‘they’ had a plan of operation… like a scorched earth type of plan, not giving the other side a chance to get out.

There is a candlestick pattern known as ‘three white soldiers’ which is essentially a bullish signal because you have 3 successive long white bullish candlesticks in a row and it tends to be a sign that a new crowd is taking hold of the tape. But looking at the tape I see not 3 but 5 of them. So I can only assume it is giving the same signal.

Now comes the question whether July 5th will be a down day or not since 5 up days in a row is rare enough as it is.

I would say that odds suggest that it will be a down day (or at least some type of consolidation hammer day) because today we hit and stopped right at the previous ‘shoulder’ of the 2/18/2011 high. It looks like a natural resistance point.

In addition 1346.50 on the sp500 is where we hit a 78.6% Fibonnacci retracement level of the decline from the 5/2/2011 swing high. So we have a Fibo resistance level combined with the 2/18/2011 price resistance level… sure does make for a possible congestion area or sell off zone for the market early next week. But then I could say forget about Fibo levels and resistance levels, it is the day after the 4th of July! This market can do 5 straight up days, so why not a sixth?

We shall see.. but Tuesday is likely to be a low volume type day I would think so I expect some type of retracement that develops into Wednesday or Thursday and then maybe an A B C up type rally after that.

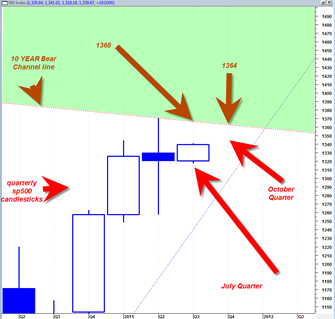

Going back to the super long term quarterly candlestick chart I can say with a reasonable degree of confidence that if the sp500 is able to achieve and exceed 1368 during the July Quarter OR able to achieve and exceed 1364 during the October 2011 quarter, then we can consider the sp500 as having successfully accomplished a 10 year channel upside breakout. Achieve, exceed AND hold the levels I just indicated above in the respective quarters… that is what is on deck for the sp500 in my opinion.

Assuming the market successfully moves into the green shaded area during end of 2011, then the next great shorting opportunity on a possible longer term basis would come in near 1600 which is the point at which the tops of the year 2000 and year 2007 connect creating a massive topside resistance band.

But for now that is still too much to chew on. In the near term the issue is whether the market can muster a topside breakout from this mega bear channel this year. I think it will, but I need to see it with my own eyes…

There is little doubt that this recent run up was the FED pushing this market up into the end of QE2 with the hope that it can build enough momentum so as to keep it going after that.

It reminded me of a 4th of July fireworks show where during the finale, there is a burst of activity at the end.

Unless the fundamentals change drastically, I still think we are headed down

That is what Larry Pesavento thinks too. He was looking for a strong rally into the new moon last Friday. If we stop at the 78.6% retracement level he could be right.. but it is a hard sell to me for now… The Transports almost at a new high and other pockets of strength.. plus there was a massive breadth thrust largest in history. I will post a link to that breadth thrust soon, it is unbelievable statistic..

No question about it, the action suggests Plunge Protection Team desperation. So be it. They serve their purpose, I suppose, kicking the can down the road. Keeping the market from collapsing (for now) protects all my income-producing holdings and hopefully keeps big capital losses down the road for a bit longer. But for me, as far as attempting one moretime, right here to trade equity index vehicles right behind the Plunge Protection Team, it’s way too political & unpredictable for me for me to game. Right here, I don’t believe the charts are a strong enough tool for me to have a profitable result in the equity markets. As Geoff pointed out in an earlier post to Tom, trying to find the right direction in this market in a month or so cost Tom 92 S & P points. I’m far too risk averse for tolerate that kind of loss in the short run, no matter what the possible gain. The equity markets are way too squirrely in both directions for my liking.

I think we will pullback another time(soon) to around 1280 then bounce yet again.