BestOnlineTrades recently developed a powerful new computer scan that scans over four thousand five hundred different stocks (Nasdaq and New York Stock Exchange). It is a superb scan because out of that entire list of 4500 plus stocks it only returned 1/3 of 1% as viable candidates! (.27%) And it typically seems to only return a maximum of 20 stocks each day. That is extremely valuable not only because of time savings, but also because of the quality of the candidates it seems to find. It is a custom scan I developed that uses a combination of two very powerful indicators. One of them happens to be an indicator that the famous Jake Bernstein likes to use a lot. But when used in combination with our own custom indicator, the quality factor goes up 5 fold.

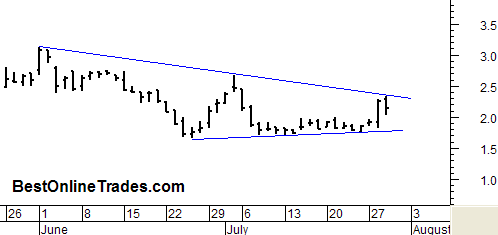

PACR Pacer International is one of the stocks that came up in the scan and we are glad that it did, because it looks quite good to these eyes. The few months to the left of this chart are also significant (not shown on the chart above) because in March PACR did a nose dive into the 1.7 range area, then it rebounded to the 5 level only to fall back where we currently are in this congestion area.

So one could say that the current retracement is a complex double bottom and now we have built sideways cause here for about a month and are perched just under the resistance line close to the mid 2’s.

I like the setup here and I think PACR could see a breakout type move if it is able to get above this top blue resistance line. If it doesn’t get above that line then something else is going on. But for now this looks quite promising and I am glad that it came up on our scan.

This is the type of lower risk setup we like because we are not dealing with a stock that has already had a huge upside move and therefore become technically weaker. Instead we have a stock that is consolidating and compressing and QUIET.

We prefer to focus on situations where there is little excitement and the action is boring. Because from a risk reward perspective it helps to put the odds much more in your favor.