The SP500 is looking quite tired lately. The fact that the market did not get a huge upside run today on the super bullish AAPL news is at least a little bit concerning. The market may be getting tired here and ready to set up a negative weekly price close going into Friday of this week.

Also, if you look carefully at the XLF financials ETF you will see something resembling an island top which is quite bearish. In addition the XLF financials ETF has already issued a ‘2B Sell Signal and it appears that the SPY has a chance tomorrow or at some point this week to also confirm a 2B sell signal.

A 2B sell signal is explained by Trader Vic here. I have seen these signals develop in the past and they have the potential to be very powerful signals on either short term or long term scales. In fact you might be surprised to find out that the entire 2007-2008 bear market was initiated AFTER a massive 2B sell signal on the DJIA.

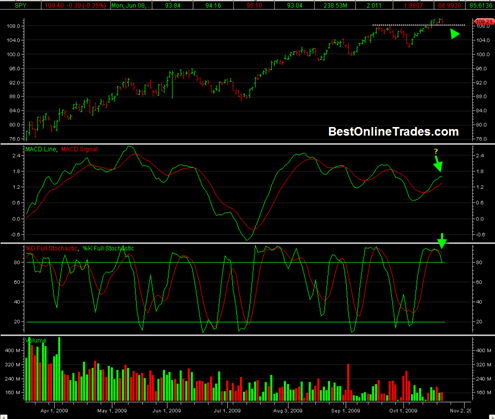

Basically the signal develops when you have price action marginally make a new high but then struggle and then succumb to bearish forces and break back under support (the yellow dotted line in the chart above).

If we gap down tomorrow morning or get a big down day tomorrow then this signal will be initiated. Or we could move flat to sideways Wednesday and Thursday and then Friday may be the big down day. The setup is there, and the XLF ETF which are the financials have already triggered the signal and they tend to be leading indicators of what is to come for the rest of the market.

Also it is important to point out that the market was down today within this window of this very negative astro date which was on the 18th of October. The fact that we did not hit a new high today could be an indication that the very negative astro aspects are starting to take hold. But if we hit a new high tomorrow or any day this week then I believe the astro signal is completely invalid. On the other hand if we break down bad during the remainder of this week, then the astro signal could be valid in combination with a possible 2B sell signal.

Once again I am a bit nervous that a more involved correction could kick in this week based on the possible 2B signal, the astro stuff and the US Dollar reversal today.

If we get a confirmed 2B sell signal, I may go long the TZA again which looks like it may confirm a 2B BUY signal this week.

Lets see if the market can prove this analysis wrong and just keep blasting higher the rest of this week.