Chinese stocks have been somewhat sloppy lately but of course it depends on the stock and industry. Some of them have been high flyers. Still, the Shanghai Composite Index long term chart depicts a picture of more consolidation in 2011 which could lead to much more bullish action later in 2011 and then into 2012.

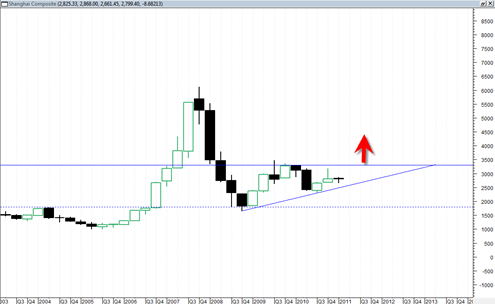

We see that the long term quarterly price chart of the Shanghai composite suffered a massive down swing in the 2008 period from 6124 to 1664. That is about a 73% decline which is massive. Since March of 2009 the Shanghai Composite Index quarterly chart has been consolidating in a large range which is taking on the appearance of a large ascending triangle.

This should lead to an eventual upside breakout and new more persistent bull market trend in later 2011. That should be more than enough time for that market to consolidate and work out all its ‘differences’ about the current direction of the economy.

I see 3300 as the very key level that needs to be broken through as the first sign that the index wants to start a major new uptrend. If the Shanghai composite is successful in breaking through 3300 then it would imply a move back up to the 5500 range eventually in my opinion. Also important is that the price range between 3300 and 5500 does not offer that much resistance so this could be a somewhat strong trend if it is able to initiate above 3300.

Note also the way the market held support in the 1660 range and bounced strongly higher from that range. So the Shanghai composite index is worth keeping an occasional eye on as a new bull trend move could lead to stronger more broad momentum again for most Chinese stocks.