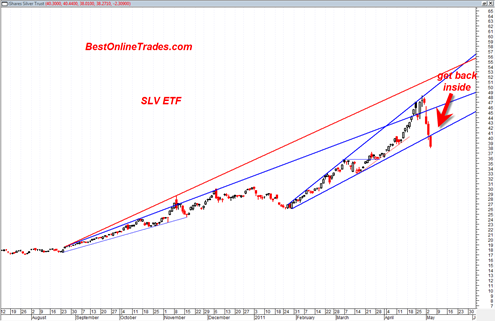

The SLV looks like it has obeyed the top channel broadening wedge resistance line and has since strongly reacted down off of it on very heavy volume.

This top channel line was known in existence for a long time and was pointed out here many times at BestOnlineTrades.com. There was a chance that the SLV could trade to an extreme above 47 for a blow off move above the top channel line but now we see that this was not meant to be.

Now the SLV finds itself trading below the bottom broadening wedge boundary line and ideally will find a way to bounce back up into the broadening wedge.

There should be some type of ‘automatic rally’ from either the current price range or a little bit lower from here that could last for several days. These almost always occur because of the previous strong momentum. But it can be an art, not a science in pin pointing the exact low before it actually occurs.

Ideally a gap down opening tomorrow would serve as the panic low and mark the low and then the SLV could trade higher from there.

The bottom line going forward for SLV is that it is likely to move into trading range mode from here. This strong sell off reaction occurred near the 50 price peak of the 1980 time frame. So this decline could be the beginning formation of a ‘handle’ of a massive 30 year cup and handle pattern.

Do you see the Possibility that the Silver would Re-test the $50 range by June?

SLV stopped dead at 50MA. This is an important support point, which SLV needs to hold. I look for a knee-jerk upswing tomorrow. It may not have legs, but good for a short term (few days) trade perhaps.

Volume was very high the last few days, meaning everyone with big profit got out. Now they have massive cash sitting on the side waiting to invest.

SLW was moving up today after lagging silver. I would think that miners will start to move up while silver moves sideways to up. Silver has also bounced off support on my indicators

The Gold /Silver ratio popped up the last several days as silver went down. We hit a Fib level today and I expect the ratio to resume its down trend which will also be good for the stock market.

I think Silver could still bounce a bit more from the current oversold level, so SLV maybe to 40 range or slightly higher.

What I noticed about silver is that it does not necessarily bounce like stocks do when there is a crash.. The bounce eventually comes but sometimes it takes a while..

Getting to 50 by June seems like a stretch.. there was too much damage done the last few days… I think 50 will come eventually again but it may take a few months at a minimum.

I think Dollar will put in a Quarterly Bottom on End of June.

I believe we still have some time for commodities to shot to the upside for another Month before the Dollar Bounce starts kickin in.

Do you See the Silver going down further from $35 level going forward ?

I doubt very much Silver will go much lower than 35. If we use SLV as a guide, the last day of the down move (last Thursday) was on extremely high volume, massive volume and this tends to put a cap on any future decline in my opinion.

I am referring to the volume on the SLV. So we should start to see more upside in SLV in the form of a further automatic rally. Then we are likely going to form a trading range between the peak of the automatic rally and the recent low of last Thursday.

We could see the low of last Thursday slightly exceeded but I think it will only be done so marginally.

We may see a bounce in silver based on the exhaustion gap we saw in the daily chart. Maybe we go back up to almost $40 and then back down from there

We don’t know how greedy JP Morgan will be on their shorts with the help of their friends at the CME. Raising margins 4 times on a falling commodity is outrageous. There maybe more pain in store

As for the dollar, the bounce has already started and will go on for several months.

Silver tends o fall at least 50% after reaching a high like it did in 1980 and 2008. We could drop to $25 and still not break the uptrend

My take still is that we will not break that much below 33.40 on the SLV ETF, but we will just have to wait and see.

As for the US Dollar I need to take a more in depth look. I am currently thinking that this recent dollar bounce will be short lived and the down trend will continue, but I need to take a closer look…