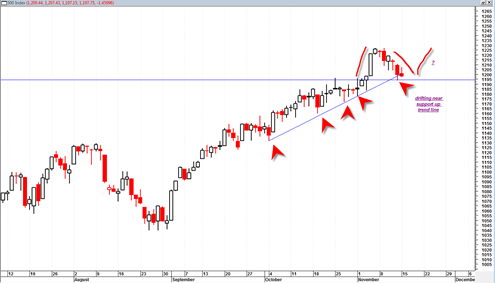

I may have been a bit too quick with the trigger finger today switching back to long signal on the sp500. I will switch back to short signal if the sp500 gets a decisive close under 1194.

Today we had a reversal after early gains. It was not an extreme reversal or a super bearish in the sense that we still contained the price action within last Friday’s candlestick bar. Still I am not sure we are done working off the overbought condition, and I am also not convinced that we are done doing a typical Wyckoff retest.

There is still the possibility that we could sink back under the previous breakout support line.

The volume today was again quite light on the indices ETFS. That lack of sell side volume is what has me thinking this retracement will be shallow. Still, a surge in downside volume could still be on deck. Perhaps the rest of this week provides more clues.

There are two factors I am still considering that could send the market much lower from here than currently seems possible. One is the US Dollar Index which again showed strength today. The second is the On Balance Volume indicator which is showing that the recent long rally despite hitting new 52 weeks is not being confirmed by On Balance Volume.

If the market is strong enough then perhaps it can do some more churning into end of this week and set up some kind of upside week thereafter into the Thanksgiving Holiday weekend.

McClellan summation is now in sell mode !

IMHO it will take either a fairly dramatic decline or a fairly protracted (til year-end) to put a sufficient dent in investor optimism to allow the market to move ahead. There are also other indicators that are just too ebullient. There is no wall of worry. There is no worry period.

Tom

your on balance graph and your spy graph show an incredible divergence.

the http://pugsma.wordpress.com/ blogger has been incredibly and minutely accurate for the past 4 wks or so and he is looking for a very shallow “correction” before the mrkt moves higher. as accurate as he has been, i just do not share his pt of view.

the Republicans are very surprisingly (to me) showing some sense of responsibility but it will require the American economy to endure some or a lot of pain but the US dollar may anticipate this and gain strength until it is clearer that the politicians can not deliver.

In a posting on Kitco today, there was an interview with Ian MacAvity where he thinks the next 6 months or so are very dicey and he would not be surprised to see a retest of the March 2009 lows.

I am monitoring T2100 indicator which as of 2 days ago turned below its 21 SMA. It popped above on Sept 1, so it has been running a long time.

I have another indicator that shows the division of NASDAQ to SP-500, and that one is running below its 10 period SMA for a while.

All indicators are negative. That’s all I can say.

I think S&P will touch 1160 and bounce back to new high. As I said before, 90 day cycle was topping….

However, correction to 1160 will end by this weekend.

this year end closing will be something like 1240 on S&P, IMO

Incredible – – at 12:20pm on Tuesday, the DOW is down 182 points and yet the ARMS / TRIN Index is only 1.23 (according to Schwab). Absolutely NO FEAR!

No fear of course, would mean we have farther to go and I think we will get there faster than most think.

Looking at the weekly Spy chart I can see there is a double top in the process of rolling over. On the IWM daily chart we have an Island top.