The sp500 is trading higher at mid day today and so far has not revealed any willingness to follow through on last Friday’s candlestick reversal hammer. The reversal hammer was not the most ideal in that it did not have a very long tail and was also within a trading range as opposed to being outside of it.

The NYSE summation index and the VIX seem to suggest that we are working into some type of top however the potential exists that this could be a rolling top and very frustrating to time. Getting short too early is usually one of the biggest risks of betting on downside price action. Tops in general are much more difficult to time given their rolling nature and reluctance to ‘let go of the uptrend’. Bottoms are much easier as they are marked by fear and panic and tend to be much more precise.

The key for today is the closing price on the sp500 today. A close near the highs today could warn that we want to make another attempt at 1300 to see if there is more heavy supply in that range. If we do rush up towards or slightly above 1300 then the trading pattern would start to resemble the formation of the April 2010 top.

What may happen is a move in the sp500 slightly above 1300 and then an attempt at a retest that fails and swiftly brings the market back down under 1300 perhaps as low as 1265. That would be a much stronger sign that this market is moving into a more extended corrective mode.

1290 to 1292 seems to be the make or break decision point as to whether we will take the ‘above 1300 scenario’ I just outlined above. Closing above that range would likely lead to a thrust above 1300.

So assuming the market wants to get above 1300, the key is to wait for the retest of the 1296 zone after the mini breakout to new highs. If this retest fails and fails dramatically perhaps sinking the market back to 1265 or 1270 then this would be a clear sign that there does exist heavy supply at the 1300 range and that we are likely building a much more significant topping range that could then later shift the market momentum to down.

But for now the day is still early and we do not have a decisive signal.

The decline that occurred on 1/19/2011 was not on blockbuster volume compared to what was seen during April 2010. This is a potential warning flag that we will not be able to break down the tape action enough to get a significant enough turn in the market.

Also the UUP ETF (US Dollar Index ETF) continues to show lingering weakness and seems still to be a supporting foundation for the market for now.

One has to be open minded that the UUP ETF is on a mission to test the 11/4/2010 price swing which could provide more supporting cushion for the market.

So when we weigh the market dynamics in each hand I have to say now that there may not be enough evidence yet for ‘heavy downside action’. There are still too many conditionals that leave doubt.

If the market is able to get above 1300 and hold ground above that range for enough days I may have to switch back to a BOT long signal on the sp500.

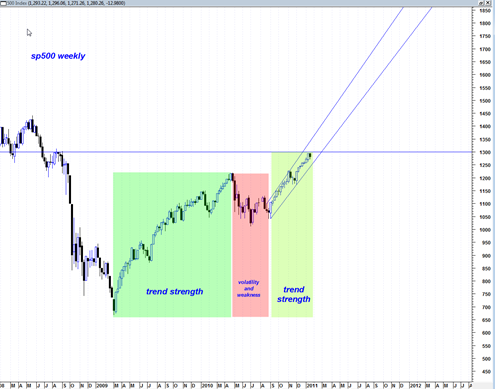

Just to rehash a bit, it is worth reviewing quickly the sections of market action we have witnessed in the sp500 since March 2009.

We had a long period of trend strength with occasional volatility starting in March 2009. Then we transferred to the swing trading range in April 2010 and this was a trading range environment and high volatility. Since September 2010 we have transferred into a very low volatility super trend strength environment. The first clue that this may start to change would be a break down in price blow the lower channel line.

This is truly a fascinating market. Fortunately, my shorts, due to the giant downside move of RSH, are well into the money. But still, I sure did not expect this upside action today!

However, could this be a blow-off?

I still like the bear side.

But who can tell.

Maybe I am just lucky.

But as Napoleon Bonaparte said “don’t tell me who is the smartest general, but rather who is the most lucky.”

It is still a dicey market to try to short… too much trend strength… no huge down volume days or huge downside candles. We need at least one big down candlestick of 2 to 3% before the back of this market starts aching I think..

I am short IWM. It had a weak rally today, and put in a topping tail on weak volume, when the biggies were rallying.

Tomorrow’s action will tell. If it falls below 50MA there is hell to pay. It WILL bring the market down – eventually.

Transports had a weak bounce today. Watch for that one tomorrow as well.

Dow moving up on the strength of IBM, pulling the rest up (same for AAPL). To me that is not a ‘real’ rally.

Funny how sometimes it just takes a few stocks to pull the market higher.. amazing.. but up is up, market does not seem to care.

Market continues to take advantage of almost every decline as an opportunity to get overbought again… very dicey to bet against that for now…