The wild volatility over the last 2 weeks I think had a lot of people probably feeling like they just entered the spin cycle in a washing machine. The market was showing huge signs of strength and then equally huge signs of weakness back and forth. In the final analysis I think we can basically say that the last two weeks the market has basically traded flat.

But a market that trades flat still means something. It means the market has created sideways cause ( or energy) for the next big move. It looks more and more like that next move is going to be down in a new panic cycle.

I can give you plenty of reasons why the market could still get a bounce to the 1100 to 1150 range but so far it has already tried to bounce above the 1100 and has failed. It may try again (especially considering the extremely heavy oversold closing Arms value we has on 6/4/2010) but my instinct tells me it will just engage a new panic cycle starting tomorrow.

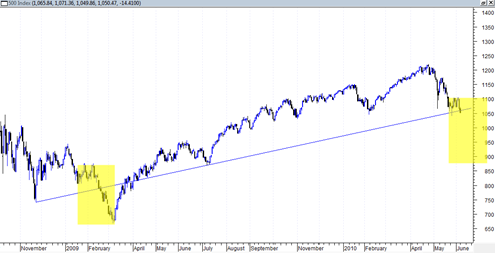

If you look at the 2/10/2009 date you will see a similar market basing period that looks quite similar to the period we are in now. Also notable is that on that 2/10/2009 there was a similar very high closing ARMS value but not nearly as high as 6/4/2010.

In addition to that sloppy bounce and trading range that occurred in the 2/2009 period you can also see that we are barely holding onto what I view as the last supporting trendline of the advance since 3/2009.

The market really needs to bounce back up to the 1100 level again tomorrow to continue this sloppy bounce or it risks falling below final uptrendline support.

I should also note that 6/8/2010 is a very big negative astro date again according to Larry Pesavento. But keep in mind that sometimes these astro days can invert and you can get the exact opposite to what was expected. That is the most frustrating thing with astro, the interpretation. Generally speaking when I see a market move hard down into an astro date I like to consider it as a potential turn date instead of a continuation. It is true that the last two days have slammed down pretty hard, so it is possible this one could invert.

So the preferred scenario is for maybe another 2 weeks of highly volatile down move starting tomorrow. This may just be a wild panic cycle with huge swings down and equally huge swings up for 2 whole weeks. But when you add everything up and all the dust settles the market will probably be significantly lower than where it stands today. I am thinking maybe 900 to 950 ? There is a supporting range there.

To keep my sanity I have to at least consider that we could also bounce once more time up from here. If you look at the chart of the QQQQ’s PowerShares QQQ Trust, Series 1 you can see that today it closed dead center right on the recent uptrend line that has marked this bounce. So it would not at all be unusual for the QQQQ’s to get at least a one day bounce from this minor uptrendline. Also note the very weak volume on the QQQQ’s today. But Monday’s are usually slow anyway so…

You can see the apparent structure on the QQQQ’s right now as that of a symmetrical triangle.

If true, then it could point to a very rough measurement of about 38 on the QQQQ’s.

It seems about the right time to get a move out of this pattern. If it delays too much longer then the squeeze out of this pattern is at risk of being much weaker.

So bounce or no more bounce ?

Well let the market decide this one 🙂

Clearly another big move is coming, but the parameters seem much clearer to me now and there are definable ranges and some good patterns here to work with.

Hi Tom,

Please do not lose your heart. You are doing good work. Soemtime, we do get confused.

I think at the moment there is no cash shortage in the market (meaning ther is ample liquidity). At the same time, all financial/economic news are bad.

If you look at market movements during such periods, you will notice, that reactions are not sharp unless bad news is WORST news.

I think S&P markets will rise by 35-40 Points. My order to short S&P at 1118 is still there and waiting for someone to buy it.

Please keep up the good work. You will make it.

Thank you… it is starting to look like the mini panic will start now….