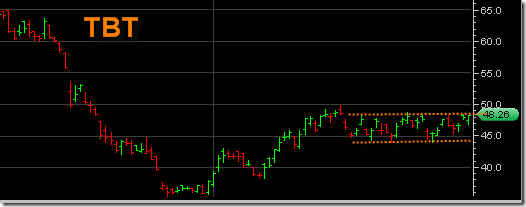

The TBT Ultra Short Long Bond ETF looks pretty good right here. It looks to me like it wants to break out of this trading range which I marked on the chart to the left.

Do I even need to explain why from a fundamental perspective this may be a good trade? Probably not. As long as you have watched just a little bit of news over the last few months you know that our government is asking for trillions and foreigners do not want to pay for it. That just about sums up the sentiment. But of course there is a difference between a long term fundametal concept like that and simple trade. Right now this looks like a simple trade. The TBT ETF has been trading sideways and range bound between just under 45 and just above 48. It looks to me like it wants to break out now or is pretty close.

ProShares UltraShort 20+ Year Treasury seeks daily investment results, before fees and expenses and interest income earned on cash and financial instruments, that correspond to twice (200%) the inverse (opposite) of the daily performance of the Barclays Capital 20+ Year U.S. Treasury Index

Perhaps the fed news tomorrow is the trigger for this breakout? I can only speculate on that part. But from a technical point of view the setup looks pretty good. Sign of strength initially beginning in January 2009 and then going into early February 2009. But then sideways CAUSE building in trading range fashion building steam for the next move.

The risk reward here looks pretty good because a stop could be set just under this trading rang support on a further advance.

Somebody has to pay America’s bills but at this point I don’t know who it might be anymore!!!