Does Technical Analysis work on the OTCBB?

There has been debate about whether or not Technical analysis works or not on tiny microcap stocks such as those on the OTC BB. I am of the opinion that it does work, however I am also of the opinion that this tiny marketplace is not one to spend too much time on. It is definintely a very illiquid marketplace with much higher risk associated with it.

However, sometimes situations develop whereby an attractive enough chart setup occurs that it warrants mentioning. This is exactly that, an attractive chart setup. The downside is the liquidity issue. It is really horrible on the OTC BB market. Sometimes it can take 30 minutes or more just to get ‘into’ or ‘out’ of such a position. Despite the drawbacks, I seem to have found a very promising setup here.

The way in which I found this setup is very unusual. And maybe it speaks to the fact that a lot of stocks in general right now are moving on speculative merits only? A lot of small stocks that is. Whatever the reason, it is happening and I am reporting it to you.

Now back to how I found this little one… I was browsing through lycos live charts and there popped up a random chart from their server. It was indeed purely random. So there it was, and immediately after I saw it I knew it was worth investigating further. I have a good knack for this, simply looking at a chart very quickly and immediately ‘getting a read on it’. Kind of like you size up a person you meet for the first time.

Anyway, the chart is USTT and it trades on the OTC BB, the relatively illiquid and highly speculative ‘wild west’ exchange. Because I am a firm believer in technical analysis, it really does not matter to me what kind of stock, commodity or index I am analyzing. All the rules of technical analysis apply to each of them.

I have a little bit experience with the OTC BB stocks, so I know how to get a good read on them. I mentioned the liquidity issue above. This is true, yes. But sometimes there are periods that alleviate some of this drawback. For example right now I am seeing significant volume expansion on a number of them including USTT.

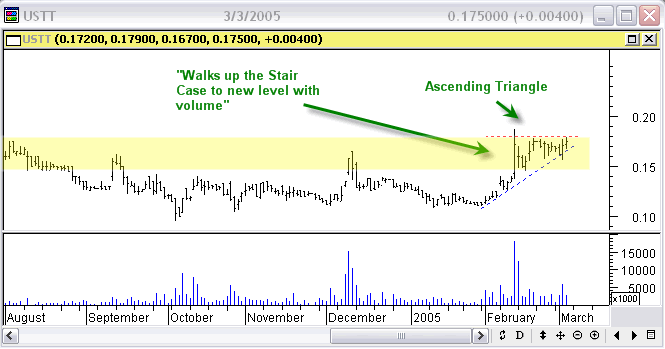

Actually the overall chart pattern setup on USTT is extremely attractive. If this were a large or mid cap stock, I would probably rate it a 9 out of 10. The pattern setup looks good to me because what you have here is a 7 to 8 month FLAT base (bottoming process) which is indication to me of accumulation. The high volume spikes within the green shaded area are some evidence of that accumulation. But then also, you have this based and accumulation building up right under a 1 year long resistance area. This one year long resistance area is indicated with the horizontal blue line. These two facts are very important in this analysis. Why? Because in my experience in technical analysis and reading stock charts over the years, this pattern identification is one of the most attractive stock chart pattern setups you can ask for. The reasons for this are simple. Number one, you have a stock that has shown us that it has completed its base during which there was accumulation. Then you also have an indication of a sign of strength with volume that takes price to a new level and holds that level. And, as you will see in the chart in the next paragraph or two, we also have an ascending triangle formation building on a nearer term basis ( a highly reliable chart pattern) right under the long term resistance line (long horizontal blue line). All of these factors together create a high probability breakout situation.

Actually the overall chart pattern setup on USTT is extremely attractive. If this were a large or mid cap stock, I would probably rate it a 9 out of 10. The pattern setup looks good to me because what you have here is a 7 to 8 month FLAT base (bottoming process) which is indication to me of accumulation. The high volume spikes within the green shaded area are some evidence of that accumulation. But then also, you have this based and accumulation building up right under a 1 year long resistance area. This one year long resistance area is indicated with the horizontal blue line. These two facts are very important in this analysis. Why? Because in my experience in technical analysis and reading stock charts over the years, this pattern identification is one of the most attractive stock chart pattern setups you can ask for. The reasons for this are simple. Number one, you have a stock that has shown us that it has completed its base during which there was accumulation. Then you also have an indication of a sign of strength with volume that takes price to a new level and holds that level. And, as you will see in the chart in the next paragraph or two, we also have an ascending triangle formation building on a nearer term basis ( a highly reliable chart pattern) right under the long term resistance line (long horizontal blue line). All of these factors together create a high probability breakout situation.

One other thing to mention is the weekly macd histogram. The weekly macd histogram shows a bullish divergence with price from the period of early 2004 until present. And, it also looks as if it is just about to crossover above the ‘zero line’ on the top half of the chart above. As I have said, I have seen these patterns many times before and I know from experience that they are high probability patterns. The fact that this is an OTC BB Stock does tarnish the setup a little bit, but nevertheless, in terms of strict technical analysis, the attractive setup still exists.

You can see from the next chart below more clearly the price pattern and the volume expansion as well as the ascending triangle. The dotted blue line represents the increasing demand meeting the fixed supply of the dotted red line. There is not much room left in the apex of the triangle, and USTT must either break down or up from this pattern. Heavy volume expansion would be the big clue that a breakout is in process. My forecast is that USTT will breakout upwards from this ascending triangle pattern.

It is also interesting to note that this company is somewhat of a play on the alternative energy theme I had mentioned in a previous post. Apparently they make an energy efficient vending machine accessory, saving buyers hundreds of dollars yearly. Another little hint about the speculative interest is the number of message board posts on USTT. I do not read or visit stock message boards, but in certain cases it is worth it for the sentiment side of the setup. The message board for this one at ragingbull.com has a high frequency of posts indicating ‘highly speculative fever’ if you will. While not mandatory, it is a useful indication of level of interest.

So in summary, USTT above .18 will probably launch into breakout mode for between 25 to 50% return potential.

P.S. I really don’t want to mention any more of these tiny ones for some of the reasons I mentioned above. But for now I am letting this one slip through, simply because of the unusual way it came to my attention. It did after all create a good story to write about…

P.P.S I am putting this post in the ‘Before and After’ category to see how this one shakes out. It should be interesting to follow up on.