The US market indices are fascinating. Whether it be the New York Stock Exchange Composite Index or the S&P500 index, they are one giant melting pot of stocks. Because they are a melting pot, they tend to move and react much slower than any individual stock would. This would seem to be an obvious point, but I have found over time that it often takes me a certain level of adjustment when trying to trade an ETF based off of an index after previously focusing on individual stocks only.

The near term action on a market index can mask what the eventual true longer term direction will be. Market indices take their own sweet time and seem to have a great ability to confuse the masses on where the big turning points will be.

Since March of 2009 the USA broad market indices have been in a general bull market. We have seen stocks of all type and variety in massive bull market trends from tech to energy to retail and everything in between. This move, 3+ years in the making, appears to have been a massive inflationary push up in equities. More recently it appeared as though 2012 was a ‘done deal’ in terms of guaranteed upside since it is an election year. The seasonal positives for stock markets during election year would put a lot of weight to the argument that the market should power higher into end of this year. But sometimes seasonals don’t work. I would rather observe technicals first and then use seasonals as an afterthought.

But now I have to question is the end near ? Are we finally at the end of this up cycle and ready for a phase 2 down in the market similar to what occurred in 2007 to 2009 ? 2007 to 2009 was a massive bear market decline that lasted 16 full months. Could it be that we are on again on the cusp of another 16 month (plus or minus a few months) phase 2 mega bear ?

I am exploring this question now.

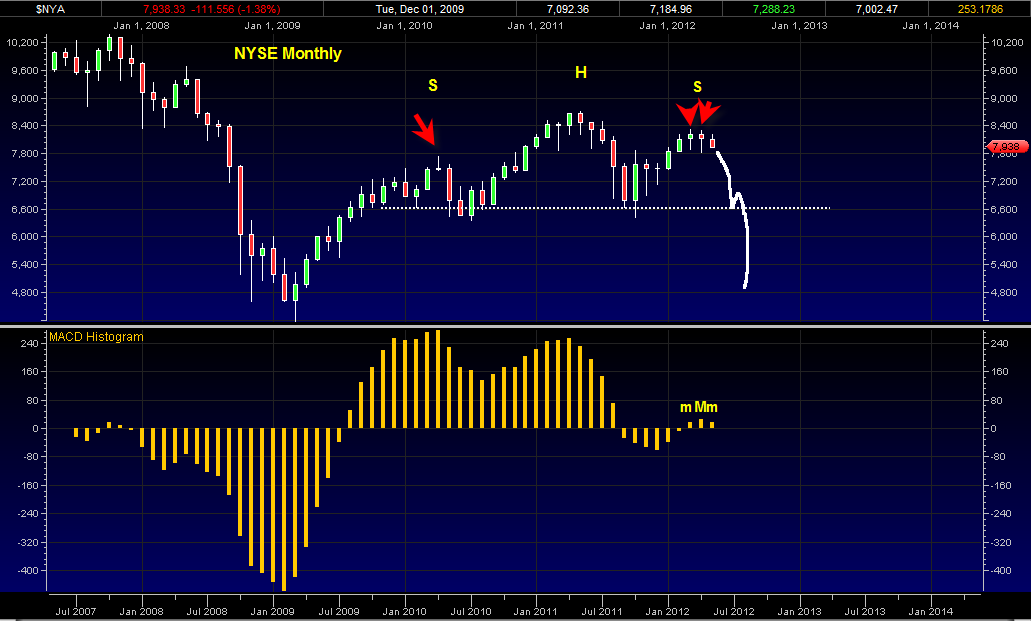

One reason I am exploring this question is the large potential bearish structure in the NYSE. It is showing a potential massive head and shoulders formation 2 years in the making. Any 2 year pattern gets my attention no matter what it is or how messy it looks.

The monthly chart on the NYSE is starting to confirm on a few bearish levels and is to be taken very seriously now in my opinion.

Here are some points:

- The left shoulder on the massive pattern above has a shooting star candlestick that marked the reversal and beginning of the May 2010 flash crash.

- The peak of the right shoulder is showing two monthly hanging man candlestick patterns which are potentially bearish on the monthly time frame if we can close on monthly basis under either one of them in the coming month(s).

- There is a bearish triple M pattern on the monthly MACD histogram. After the month of May is done, then a close under the low of the May 2012 price bar would confirm the bearish sell signal on the monthly.

- The right shoulder completion of such a large head and shoulder pattern is usually formed very quickly and could lead to a rapid price decline of a speed which surprises most going into end of this year.

- It is important to note that the NYSE failed to exceed the previous high of April May 2011 during the recent April May 2012 price action, this is potentially very bearish.

- The seasonal tops are almost unbelievable. LEFT SHOULDER formed April-May 2010, HEAD TOP formed April May 2011, RIGHT SHOULDER formed April May 2012.

It is true that other indices such as DJIA and nasdaq do not have any head and shoulder pattern at all. Instead they are more like ‘3 drives to a top’ type patterns which can still be quite bearish.

So the picture I see from today onward is very bearish indeed. We need more confirmation but so far it is NOT looking good for the markets the next few months.

On Friday the 13th of April 2012 I pointed to a first observation of possible bearish tendencies for the market. Now with a few more weeks price action the evidence is starting to weight much more heavily on a confirmed bearish case here going forward.