The sp500 is still trading within a very large trading range. It is looking like we are headed on a clear path to 1230 or so for a test of those swing highs. The 1230 is right at the top of the current large trading range.

So it seems like it is too late for new longs from here and too early for any shorts on this market.

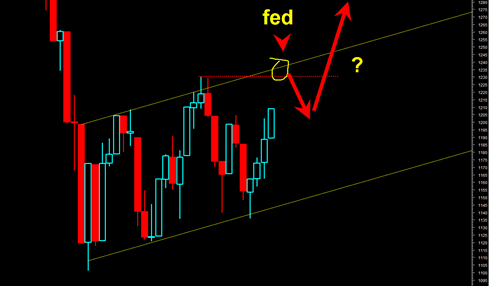

My take is we pop up to 1230 then form a doji or something similar and then flat line into the Fed meeting next week and then get a drop going back inside the trading range.

But then the market may grind higher again in this very large flag, or the flag may morph into a large extended rising wedge.

Honestly I do not feel like shorting this market or going long. I prefer to wait for the next big trade. There are still plenty of bearish possibilities for this market so my take is if the bear is still alive then there will be a good chance to re short and hold short for multiple weeks (maybe 3). BUT the timing of that 3 week short is obviously crucial.

I have been looking a the structure of the bear rallies in 2007 and 2008 and can see that several messy flags formed there as well and some of them lasted a good amount of time, in one case 2 to 3 months.

It is too early to say whether we can rise in a large flag for 2 months from here but I am willing to wait if I know it will lead to a 3 week buy and hold shorting chance that involves a huge move.

I am also watching copper price closely on the weekly chart and want to see if it breaks support in the weeks ahead as it did in 2008 before the massive deflationary plunge. There was a period there where copper took the lead down and then the market fell apart.

If we truly are in a recessionary or deflationary environment then we should eventually see copper break down and get the ball rolling.

I will be watching both copper and the sp500 for clues on the next big trigger point.

I will be using the weekly charts on both. Honestly the weekly chart of sp500 could suggest we tread higher for multiple weeks and it could be messy and choppy. But again, I want to wait for the big turning point if there is one and then buy and hold short after that.

Eventually I will post some charts of the 2007 2008 period to show how the current bear flag might morph. This current trading range we are in now is not mature enough. It still has a lot more formation to it in my opinion. Patience is key here.

Have to also consider October earnings and that stocks may try to run up into those earnings.

For now here is the near term price action:

Again, I think this pattern has a lot more construction needed for enough cause for the next move. If we are still in a bear then this pattern will eventually morph into a point were it will be time to short for a duration again.

The big moves come out of big patterns. Lets let this pattern get bigger first.