The Direxion Daily Small Cp Bear 3X Shs TZA ETF is showing a bullish divergence between MACD and price. Divergences always have the strongest potential signals in any market. They don’t always work out on first signals, but a lot of the time they do and they can lead to big price moves.

The Direxion Daily Small Cp Bear 3X Shs have been beaten down beyond belief and I suspect a complete role reversal between the TZA and TNA ETFS.

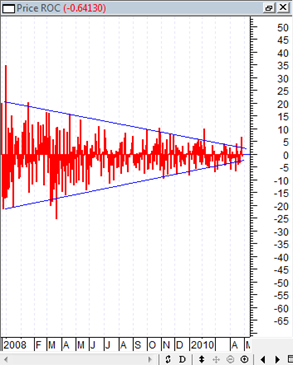

It is also very interesting to note that the price volatility on the TZA since the 2008 price lows has declined to almost negligible volatility. This is important because extended periods of low volatility usually precede periods of high volatility and vice versa.

The chart with the red histogram bars shows the price percentage changes on a daily basis since late 2008. You can see that the price percent moves on the TZA has compressed into a tight range showing very low volatility.

However now I believe all that is about to change and we should start to see much larger average price moves in the Direxion Daily Small Cp Bear 3X Shs TZA ETF.