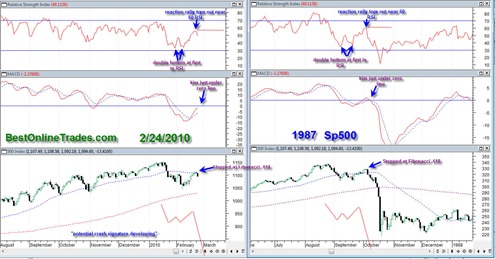

I have identified what may be a potential deflationary crash window developing in the SP500. The ‘window’ for this to occur is during the next 15 to 20 trading days. It is unlikely we will get an exact repeat in terms of price action, but I am just drawing on potential possibilities here. The comparison I have drawn just shows the pattern similarity and thus the potential ‘window’ for a semi repeat scenario.

The behavior of the market since the January 19th, 2010 high to February 5th, 2010 was a ‘sign of weakness’ on much heavier than relative volumes we have seen during the entire rally since March. Then, the current reaction rally from February 5th, 2010 to present day is once again on lackluster volume. That volume characteristic, combined with the oscillator pattern analysis in the chart above creates a potentially compelling crash window scenario. But once again, 9.9 times out of 10 the market usually chooses a more orderly slow type decline. We simply will not know with any degree of certainty what window the market will choose until it actually does. See the bullet points below for more.

But briefly, before you do that, a few words about the chart at top. The similarities I am seeing in the two time frames show that we had a decline under the 50 day moving average for a total decline in magnitude of about 9.2%. That first leg decline in 1987 was about 8.7%. In both cases each decline created a double bottom in the 14 day Relative Strength Index as shown in the chart. Thereafter a rally developed that took RSI near the 60 range and also moved price into the zone of a fibonacci 61.8 retracement from the highs. After that point is when the real price destruction took hold and price raced right through and below the 200 day moving average.

In order for the scenario to occur without fail the following must occur:

- The daily MACD on the current sp500 must begin to start curling over into a daily bearish crossover soon(within 5 or so trading days). It would be ok for the daily MACD to extend slightly higher and even slightly break above the zero line, however the less it tends to do so the better in terms of this scenario being correct.

- The market must not trade any higher than 1116.56 within the next 5 to 10 trading days. It is imperative that this be the case. If we do trade above that level then the exact opposite of this proposed scenario may occur.

- Ideally, within the next 10 trading days the SP500 should trade at or below the 1084 sp500 level. This level would break the current minor uptrend since February 5, 2010 and also take us below that key supporting shelf of the November-December 2009 time frame.

- Assuming the market is able to trade below the required 1084 level, then we would want to see relatively FAST and WIDE price destruction (sign of weakness candlestick bars) combined with very heavy volume that is bold and dramatic.

- Any rallies once under 1084 should really only be intra-day rallies, but there should be a very clear persistent down trend easily drawn with a trendline.

- The market drifting around at these levels for too long a period would make this scenario fail. Assuming a bearish daily MACD cross occurs, one would want to see immediately from that point onwards, fast bold price destruction combined with robust volume! If not then once again, the window will likely turn invalid.

After looking at all Dow Industrial Average 30 stocks, it certainly does not seem like such a thing could occur at this time. The structure of many stocks in that index still looks constructive. On the other hand I can probably make almost as many cases for stocks that are in dire need of more correction (ie. Apple Computer AAPL, and Amazon.com AMZN – needs to fill that large gap!).

In addition the XLF financials ETF Index looks like an almost perfect large scalloping or rounding top formation. The problem with that conclusion is that scalloping and rounding tops of that nature can evolve into very cumbersome price declines that are very choppy. That does not seem to support the case of a severe down market shock.

What About the Euro and the Dollar?

If there is one thing that would cause this market to engage into a panic mode it would be the very rapid movement of either the Euro or the Dollar Index. So far the dollar still looks strong and appears to be ready for yet another up leg. On the contrary the bounce in the Euro so far has been very disappointing and could imply more near term weakness, if not climax selling into a new low.

Right now the market just feels like it is holding on for dear life and still has yet to reveal what the real trading pattern will be for the rest of 2010. I feel as though this crash window is maybe the last real chance for the ‘heavy bears’ to get the real outcome they want.

The alternative?

The alternative is the complex swing trading range that I have been talking about in recent posts. The one that frustrates bears and bulls alike into total confusion waiting for a real final outcome months down the road.

Action Plan ?

Assuming we do get a daily bearish MACD cross in the days ahead on the SP500 I may once again try the TYP triple bear nasdaq ETF or the TZA triple bear Russell 2000 ETF. But the market is really going to have to show me lots of weakness for me to step up to the short side again. Weakness in terms of price and in terms of heavy downside volume.

great analysis at least this is the pattern in most crashes incl. the one in India in Jan 2008 which is the market I follow. Just one more thing look for similar evidences in other markets and commodities they are the first to crack

Wrong as usual.