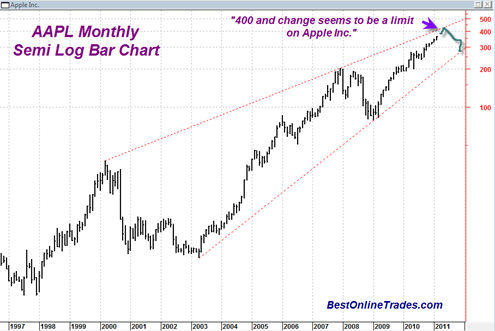

The very long term semi log bar chart of Apple Inc seems to be suggesting that it could top out near 400 and change. Today Apple Inc closed at 363.13 and so it seems not too far away from this round number target.

Apple Inc has clearly been a monster of a stock and maybe the ‘lead bubble stock’ of the current bull run. It its seemingly unstoppable with growth prospects outstanding products and brand strength that would seem to be second to none.

What will stop Apple Inc or at least slow it down ? Inflation? Competition? I really do not know. But I do know that Apple Inc. is rapidly approaching the key top channel line of the long term price chart.

I think most traders and technical analysts will agree that until Apple Inc. shows signs of serious topping, the market is unlikely to go through a ‘real’ correction. We need Apple Inc to top out or slow its upside progress before the market can start to weaken more significantly and persistently.

It looks as though Apple Inc. is about to do a final surge right into the 400 dollar price range and probably push slightly higher than that at first. Keep in mind that the above price chart is on the monthly scale so each price bar represents one full month.

Assuming Apple Inc pushes up into the 400 dollar range there are a few possibilities. One possibility is that the price reverses quickly and dramatically within only 1 months time and then starts a quick correction to 300 range.

Another possibility is that the stock ‘hugs’ the top channel line for several months before finally giving up, similar to the way it did in late 2007.

The last possibility is that Apple goes into overdrive mode and breaks UP and THROUGH the top channel line evading any bearish signal. This seems like a remote possibility but it is important to be aware of it. Sometimes top boundary channel lines are broken through as a stock goes parabolic up through it.

My take is that we see Apple Inc hug the top channel line for several months before turning down. What ‘news’ will create that type of turn is unknown. Interestingly the time frame on a meeting with the top channel line works well with the mid June 2011 8.6 year Marty Armstrong cycle turning point. Given the current strength of this stock I would be quite willing to just let it trickle up right into the mid June 2011 time frame for best possible odds of identifying the real turn.

Tom,

Good to see a post on individual stocks after a while. You seem focussed on Index/ ETF’s lately. What are your thoughts on other momentum stocks like LVS, NFLX, BIDU with the market in powerzone.

Well of the three you mentioned, LVS looks like the best possible risk reward setup since it is still consolidating within a long range and could bust topside in a new move soon if it can overtake resistance. BIDU and NFLX I would watch their steep uptrendlines and trade along those as long as they are not violated…