Today the sp500 initiated a massive MARIBUZU candlestick low volume rally. It was a perfect maribuzu today on the sp500 where the open was equal to the low and the high was equal to the close exactly.

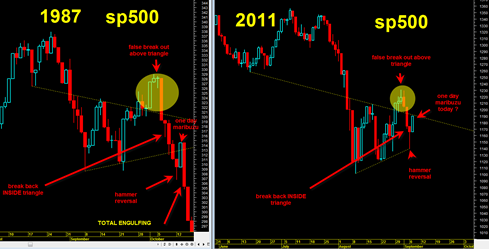

There was a similar maribuzu candlestick in a different time period… October 13, 1987. The candlestick after October 13, 1987 started down right from the get go the next day and fully engulfed the previous days maribuzu.

Based on the pattern similarity between 1987 and 2011 I would say that the sp500 really needs to start hard down tomorrow for the pattern similarity to stay intact. If tomorrow is a big up day then it would possibly open up a bullish scenario for the sp500 because it would be a close above the symmetrical triangle again.

For the symmetrical triangle to keep the option of it being a busted pattern we need to see price start down again tomorrow and try to take out the bottom of the triangle.

Note on the chart above where I indicate the hammer reversal. The hammer reversal and the maribuzu candlestick the next day is almost identical to the 87 experience. It is clear to me in the chart that in both cases of 87 and 2011 there was a false upside breakout from a symmetrical triangle and then some trading back inside the pattern. In 87 there was that one last maribuzu candlestick and then the real drop.

For us to stay ultra bearish in the current time frame I really think we need to fully engulf today’s bullish maribuzu and close down hard tomorrow.

To be honest I am a little bit skeptical this can occur despite the title of this posting.

On the 60 minute candlestick chart into the close I see we did a ‘tweezer top’ candlestick pattern. If confirmed within the first hour of trading tomorrow (an hourly close under the low of the pattern) then it could mean we head down straight out of the gate tomorrow.

I really think to keep the near term bearishness of the market intact we need to head down right away tomorrow. If we do not do that then unfortunately I have to start considering that we have a more established bottom in place.

I suppose we could rally tomorrow and then reverse by end of day into a neutral or negative close, but I still prefer the immediate down version.

Time wise as indicated in yesterday’s posting, NOW would be the ideal time frame to initiate the next leg of the decline. Everything is lined up for it.

I suppose it boils down to the question whether all the kinds men and all the kings horses can once again pump the markets up and save them with bailouts + QE3 and other stimuli.

The difference between the present time frame and the September 2010 time frame is that this time around the monthly MACD (bull bear market indicator) is on the cusp of a bearish crossover. In 2010 Sept. the monthly MACD was not in that stance and then came Jackson Hole and the market shot up in a straight line. So if we compare 2010 Sept to 2011 Sept it seems a somewhat unfair comparison for those who argue the market will go up in a straight line from here.

It would almost be surreal to see the market close hard down tomorrow and fully engulf today’s bullish maribuzu candlestick. If it does occur I think I will almost be shocked for the simple reason that so many times in the past the ‘system’ and the ‘powers that be’ have managed to save the market right before the mega drop.

Having said that, if it does occur (fully engulfing today’s maribuzu to the downside) it would be the most bearish piece of price action I can imagine.

P.S. If the market closes above 1210 tomorrow I will switch back to a BOT Neutral stance.