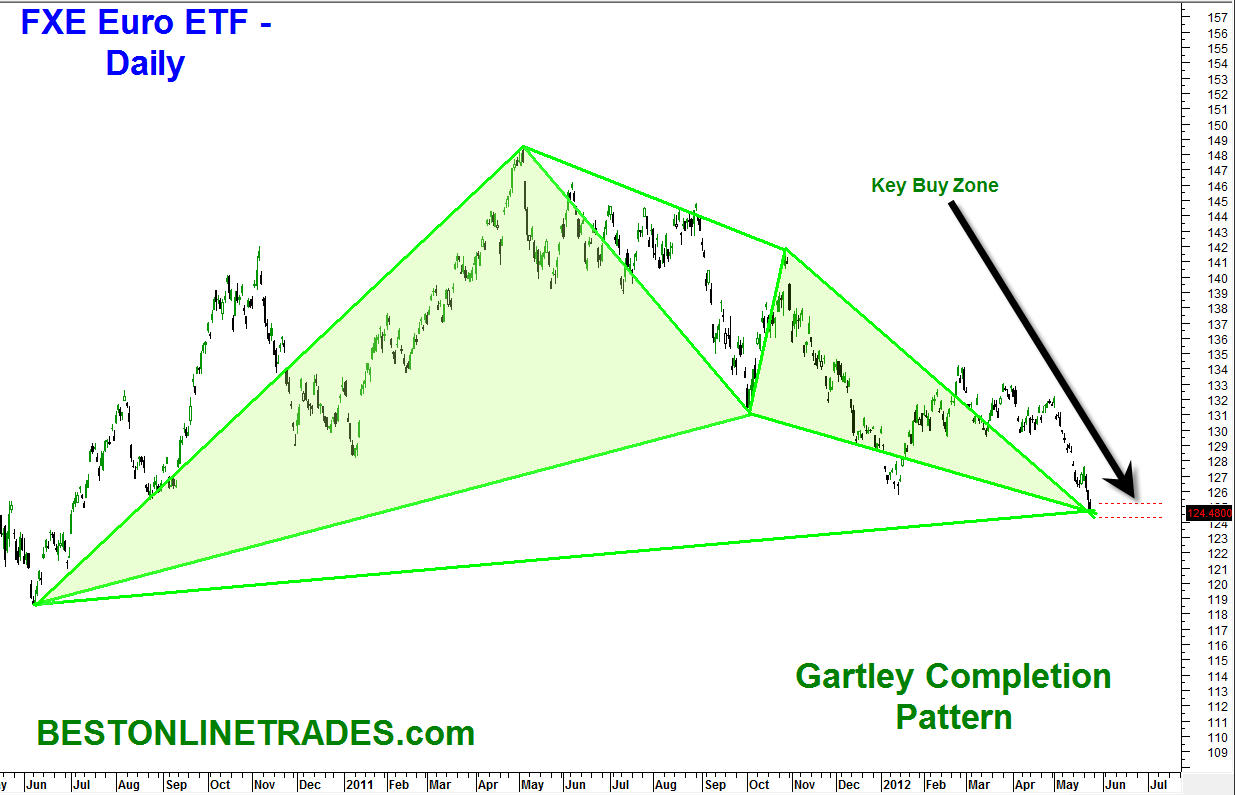

There is a strong probability that the EURO (FXE ETF) bottomed last Friday May 25, 2012. Best Online Trades has identified a key piece of evidence that shows the Euro probably bottomed last Friday based on a quite large Gartley buy pattern. This looks like an extraordinary potential trade setup.

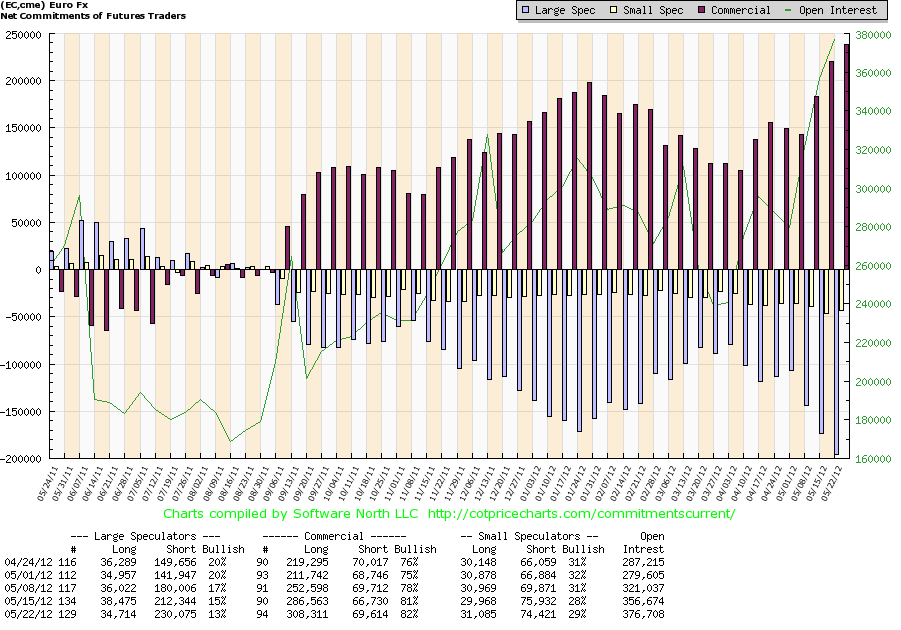

In addition to the large gartley buy pattern in the FXE Euro, also important to note the following chart:

The above chart is basically saying that the commercials are heavily long the Euro right now and the commercials are right most of the time.

If we are correct on the Euro then one might infer the following as well:

- The UUP or US Dollar index has topped.

- Gold has hit final bottom as well as silver

- The US equity markets have bottomed.

- Oil May have bottomed as well.

The Gartley Buy pattern in the FXE ETF shows that the FXE has the opportunity to bottom in the 124.31 to 125.21 zone. We believe the Euro will take the opportunity and run with it.

We are also seeing bullish Gartley completion pattern in GLD ETF GDX ETF and also USO ETF (Oil) and even Palladium ETF and KOL coal ETF.

Perhaps it is a bit too early to jump too far to the conclusion that just because the FXE likely bottomed that this automatically suggests the USA equity markets bottomed as well. But for now this is what it looks like to me and also in combination with other bullish gartley patterns on some commodities.

I am not seeing significant buy patterns on the USA indices at the current juncture, so the jury is still out how sustainable longer term the potential bottom in the USA market is.