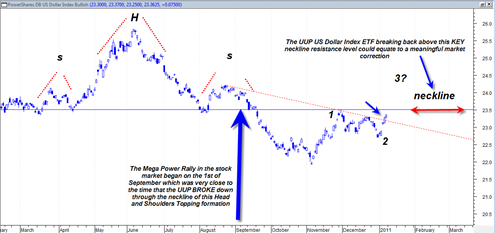

If the PowerShares DB US Dollar Index Bullish UUP ETF in the next week or two is able to break back above the head and shoulders neckline resistance level, it could spell trouble for the stock market and bode well for inverse ETFS and leveraged inverse ETFS such as the TZA.

The break down of the UUP ETF through its neckline in very early September 2010 correlated nicely with one of the biggest stock market rallies in decades.

But now, it appears the exact opposite is about to happen and one has to wonder what effect it will have on the stock market.

If the inverse correlation still exists then we should see an important stock market turning point within the next 1 to 2 weeks. If one looks very carefully at the UUP ETF price chart superimposed over the sp500 it can be seen that sometimes there exists a delay factor between any new sharp UUP rally and the eventual stock market reaction to that UUP rally.

The delay factor can be between 4 to 8 days or longer depending on what time frame we are comparing. In the case of the April 2010 top in the stock market there was about an 8 day delay before the stock market began to crumble. The UUP had about an 8 day rally before the stock market started to fall rapidly.

In early November 2010 there was about a 4 to 5 day delay before a more involved stock market reaction.

Currently the UUP is in rally mode day 5 from the key 12/31/2010 spike low day.

I believe the UUP crossing through and above the 23.50 level will be very important to watch for during the next two weeks. It could cause an important turn in the sp500 which appears to be the case anyway after a thorough study of important indicators.

Your analysis is right on. Excellent reminder of this important correlation.

Actually the close on 8/6/2010 was $23.35. Current close is $23.36. We are already there, on high volume the last few days….