One of the problems with rising wedges is that they can sometimes fail just like any other technical analysis pattern. I have been thinking about the rising wedge I just discussed in the post previous to this one and it occurred to me that rising wedges are probably more reliable after they form from a clean straight line move.

The rising wedge in recent weeks has formed after a series of complex sideways corrections and I am starting to doubt the validity of it.

Today’s hammer candlestick reversal was quite powerful and although it was only a one day move, it may be confirmed as bullish on this coming Monday if we close above today’s high. It looks like a very strong hammer reversal and the bounce was off of the bottom supporting line of the current so called rising wedge. The long tail on today’s candlestick shows demand. The fact that this reversal came on a Friday is also important.

The other odd aspect of rising wedges is their ability to keep squeezing prices higher and higher further into the apex of the wedge than is seemingly even possible.

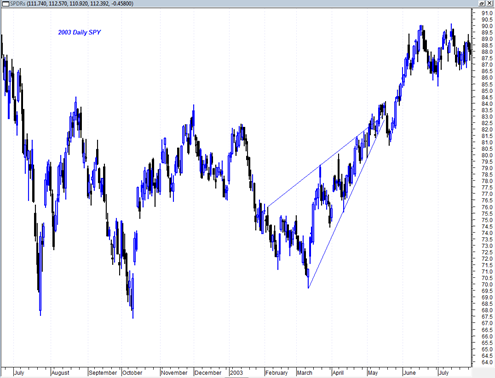

The current market environment reminds me a little bit of 2003 time frame when the market had done a triple bottom and then took off north when the bombs fell in Iraq. That first advance did take somewhat the form of a rising wedge but instead of breaking down from the wedge it just kept sort of squeezing its way higher and higher. There was a little bit of a break down but it was never enough to call it a real break down of any magnitude.

Today’s test of the bottom supporting line of the so called wedge is the 4th test of support which appears to be successful. This is significant because it may start to give the bulls a lot more confidence about an uptrend if they keep touching this line and bouncing higher off of it.

Remember, the element of confidence builds more slowly in the market than fear causes a market to fall.

Using a daily log scale on the SPX aren’t we seeing a perfect channel forming with Friday’s pull back?

You mean the channel that began from July 1 ? There is a channel also but it is also a rising wedge.