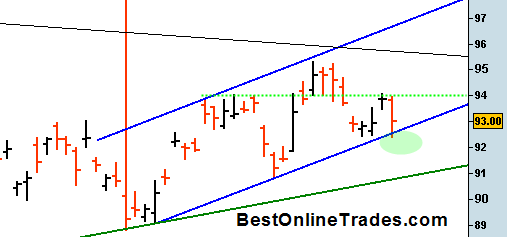

The GLD ETF slightly violated the blue uptrend channel I have been talking about this week. The close was inside the channel however and the volume on today’s decline was really light. I don’t like the fact that we slightly pierced the channel today but for now it is not the end of the world.

Within this up trending channel there is a slight tendency to an ascending triangle pattern with the green dotted line being the supply line and the bottom blue line being the demand line. If I am correct in that assessment then it implies that there is not too much room left in the apex of this ascending triangle and either the pattern fails or we get a topside breakout out of the pattern which would have measurement implications within the critical upside breakout area.

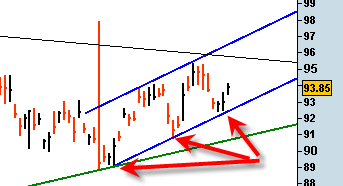

The SPDR Gold Trust (ETF) GLD was able to get a nice bounce going today off of blue trendline and channel support.

The SPDR Gold Trust (ETF) GLD was able to get a nice bounce going today off of blue trendline and channel support.

After a violent retesting action in the UNG ETF I believe that UNG has now bottomed and should embark on an eventual retest of the 17.55 level.

After a violent retesting action in the UNG ETF I believe that UNG has now bottomed and should embark on an eventual retest of the 17.55 level.