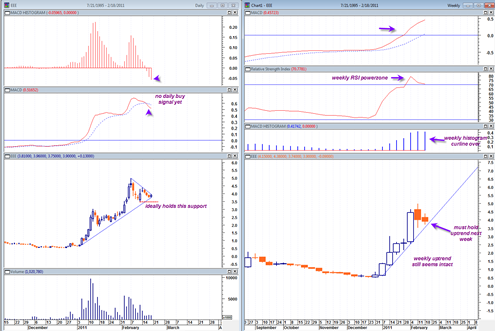

Today seemed like a bi polar day in the markets. The market was up down and all around trying to figure out what the jobs report means. Had we closed at the lows today then we would have fully engulfed yesterday’s candlestick and potentially created a bearish scenario for next week. We would also have started to create a similar looking situation to the April 2010 topping formation where we saw violent up rallies that were fully retraced down the next day. That happened several times in end of April 2010 before the market fell apart.

This higher volatility and next day full retracement of a previous day’s surge higher could be a hint of more downside volatility to come.

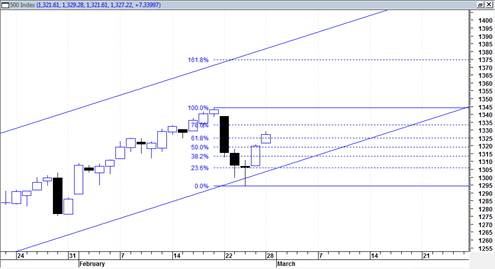

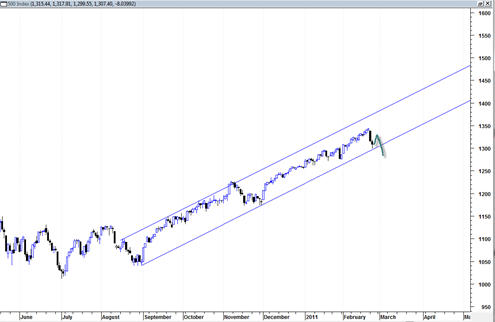

But still, when I look at the zoomed in price action of the sp500 I see that we are still holding the channel supporting line (bottom solid blue line) and today we tested it again and rejected it by end of day. We are also still trading within the broadening wedge pattern.

So trading discipline and tape reading suggests that we are still in constructive form and could press higher next week. We are still creating higher lows after the recent mini correction.