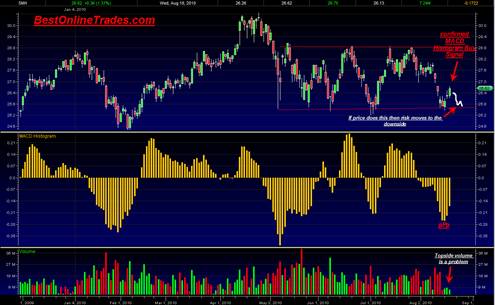

The SPDR Gold Trust (ETF) appears to be close to a weekly confirmed MACD histogram buy signal. The GLD ETF needs to get a weekly close tomorrow above 118.42. Currently it is trading at 118.56.

A confirmed weekly buy signal on the MACD histogram tomorrow would in our view be very significant as we are just 2 weeks away from the seasonally very powerful month of September for the gold market.

The weekly chart also shows a weekly reversal hammer of 2 weeks ago in which the trading low of that week tested the neckline of the previous head and shoulders bottoming formation.

The SPDR Gold Trust (ETF) also shows that it was able to crawl back above topside above the longer term up trendline. This recent move appears to be creating a handle of yet another cup and handle formation which the gold market has been quite famous for time and time again.

One could also argue that the recent 8 to 9 month consolidation resembles that of an ascending triangle formation but is also a cup and handle pattern contained within it.